Stock insider trading has been a topic of much debate in the financial world. As investors, it can be difficult to determine what information to trust when making decisions about our investments. In this blog post, we’ll explore the good, the bad, and the ugly of stock insider trading.

We’ll look at the pros and cons of investing in stocks where insiders are trading, as well as examine the legal and ethical implications of this practice. By the end of this post, you’ll have a better understanding of how insider-trading can affect your investments.

What is Stock Insider Trading?

Stock insider trading is the buying and selling of stocks by company insiders such as company executives, board members, and large shareholders. It is based on the idea that people who are in the know about a company’s operations have access to valuable information that can be used to make successful investments. As such, insider-trading has become a popular activity among investors who wish to get an edge in the stock market.

The concept of stock insider trading has existed for many years, though it was only recently that it became regulated. Nowadays, it is heavily monitored and regulated to ensure fairness and transparency. To partake in this legally, investors must register with the Financial Industry Regulatory Authority (FINRA) or the Securities and Exchange Commission (SEC) and submit a Form 4 document for every trade made.

One of the best ways to find out about insider-trading opportunities is through specialized websites that focus solely on this type of activity.

These best insider trading websites provide detailed information on stock trades made by company insiders and allow investors to analyze and compare different trades. With these websites, investors can easily identify stocks with potential for growth and make informed decisions on when to buy or sell.

The Pros of Stock Insider Trading

One of the major benefits of insider trading is the potential to make huge profits. When an insider has access to non-public information, they can use that knowledge to make strategic decisions that could yield large returns. This makes it attractive to investors who want to capitalize on these opportunities.

Another advantage of stock insider-trading is that it allows investors to get a head start on market trends.

By having access to information before the public, insiders can position themselves to take advantage of price changes before they happen. This can help them maximize their return on investment. For those looking to get started in this, there are several great websites out there to assist you.

Best Insider Trading Websites provide investors with insider data, as well as other resources and tools to help them make informed decisions about their investments. They also provide tutorials and educational materials for those new to insider trading. With the right resources, you can become a successful stock trader in no time.

The Cons of Stock Insider Trading

Stock insider trading can be a risky venture, as it is possible for investors to get caught up in the hype and make unwise decisions. There are a variety of potential pitfalls, including the chance of getting burned by inaccurate information or illegal trades. Even if the trades are legal, investors could still lose money due to market volatility or their own inexperience.

Additionally, insider trading can create an uneven playing field between different investors. Insider trading gives those with access to insider information an advantage over other investors who may not have the same resources.

This creates an environment where individual investors can be taken advantage of by larger institutions and hedge funds that may have an unfair edge. Finally, investors should also be aware of the potential for fraud and scams when using best insider trading websites.

Many such websites are unregulated, and it is easy for shady individuals to provide false or misleading information in order to take advantage of unsuspecting investors. As such, investors should always do their due diligence before making any investments based on insider trading tips.

Is Stock Insider Trading Legal?

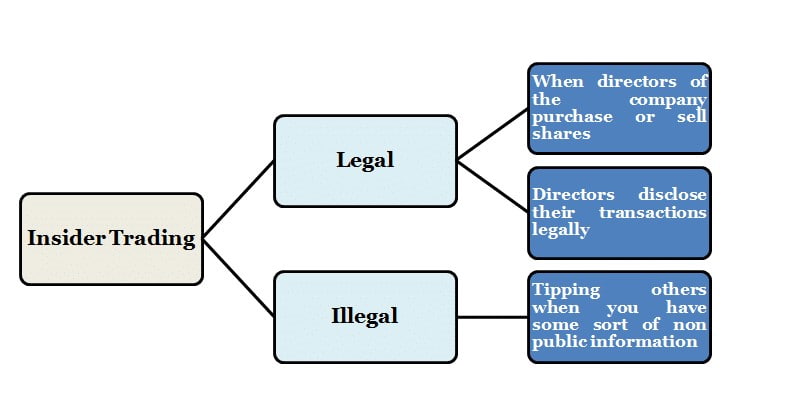

Stock insider trading is legal, as long as it is done in accordance with the rules and regulations put in place by the Securities and Exchange Commission (SEC). The SEC is responsible for monitoring insider trading activities, and ensuring that investors are not being taken advantage of by those with more access to information.

It involves buying or selling shares of a company based on information not publicly available. This type of trading is only allowed if the investor has a legitimate reason for knowing such information and does not use it to their own advantage. For example, if an employee of a company knows something about the company’s future prospects that could affect its stock price, they are prohibited from using that information to buy or sell stocks.

If you’re interested in taking part in stock insider trading, there are a number of best insider trading websites that can provide you with real-time stock information. These sites allow you to monitor stocks and analyze data to make informed decisions. It’s important to note, however, that you should always comply with the SEC’s guidelines when engaging in insider-trading.

It’s also important to remember that stock insider-trading carries risks. Just like any other type of investment, there are no guarantees that you will make a profit. Therefore, it is important to understand the potential risks associated with insider-trading before engaging in this activity.

Conclusion

It is a risky endeavor that can potentially have both positive and negative impacts on your finances. As such, it is important to do your due diligence before engaging in stock insider-trading, and it is wise to use the best insider trading websites to help you understand the complexities of the market.

There are some significant risks associated with this, so be sure to consult with a qualified financial professional before making any decisions. That being said, if you are willing to take the risk, this can be an effective way to make money. However, it’s important to be aware of the legal implications of stock insider trading and to understand the full implications of your actions.